Oil & Gas Reserves Assessment

The earth contains enormous quantities of oil and gas resources but, nowadays, for many reasons as well technical as economical only a tiny conventional part is really exploited.

Oil and gas reserves are usually estimated within a volume of rock appointed to constitute a favourable setting for hydrocarbon entrapment.

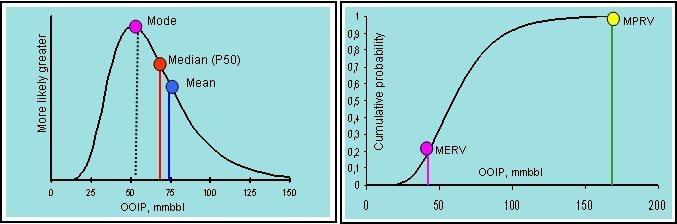

But the only way to check the presence of hydrocarbons is to drill a well. As for the volume in place, deterministic as well as probabilistic volumetric methods are used but he who would like to know the right (deterministic) reserves of a field should wait… the end of the exploitation period.

Nowadays, reserves’ thought tends to have a commercial consideration rather than geological one. By the end of the Nineties, with an oil price of 10$/bbl, many oil fields with moderate reserves were marginalized and forsaken by oil companies. During the period 2005-2014, with an oil price over 100$/bbl, the NPV of these same fields crosses the economic threshold of the companies.

The NPV of an oil field is controlled by a multitude of independent or inter dependent factors and parameters (recoverable reserves, oil price, taxes, recession,…). If we consider a top10 factors historically recognized as being the most influencing an oil field’s NPV, excepting the behaviour of the oil market, six (06) parameters are associated with recoverable reserves.

If the other parameters and economic factors (inflation, oil price …) are often variable and unpredictable, reserves volume should remain, in the same time, the most stable parameter and the most influencing factor in the economic evaluation of an upstream project.

So: reserves should be estimated out of any alarming pessimism or unbounded optimism.

Reserves & Resources assessment I provide concerns:

- Unexplored wild cat areas

- Unproved reserves for new prospects in explored areas prior to drill

- New discovered field

- Remaining reserves in producing mature areas

Reserves assessment consists of:

Oil, associated gas, gas, and condensate (in place and recoverable)

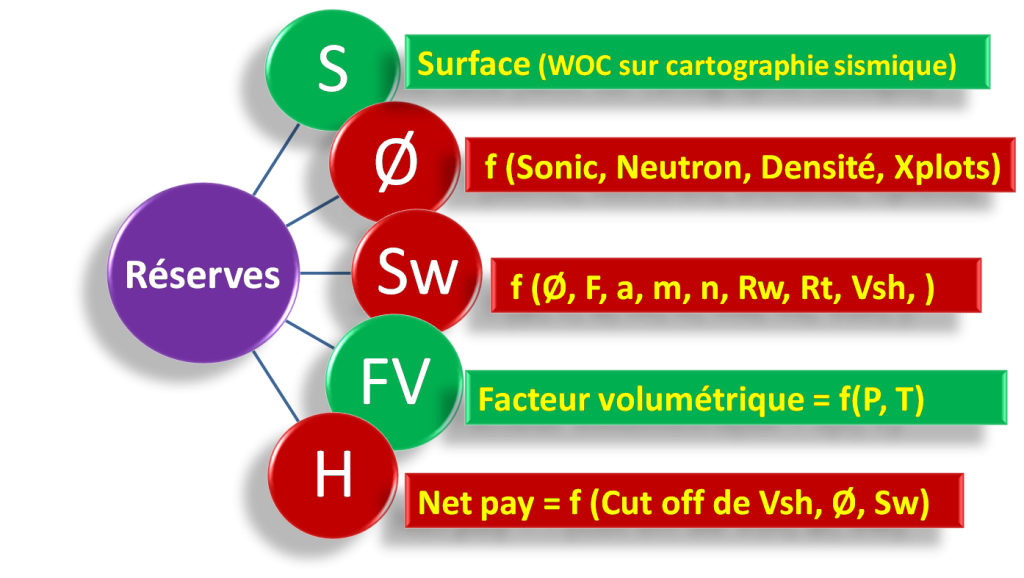

My Reserves assessment method is based on:

- Both Metric and/or Anglo-Saxon system units.

- Modern concepts and current international standards officialized by the SPE (Society of Petroleum Engineers) and the WPC (World Petroleum Congress).

- Probabilistic approach of Monte Carlo making possible to know the reserves P10, P50 and P90 and then the MPRV- Maximum Possible Reserves Volume as well as the MERV-Minimum Economic Reserves Volume for the economic evaluation.